Iron Mountain (NYSE:IRM) Appoints New Data Center EVP As Share Price Dips 9%

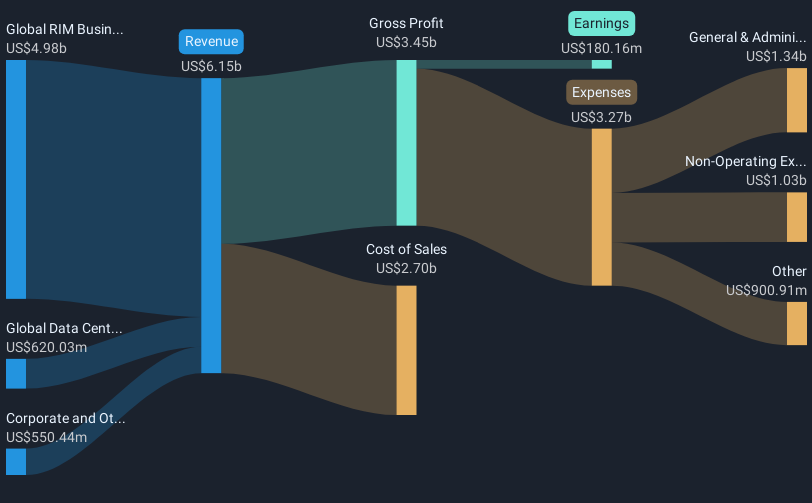

Iron Mountain (NYSE:IRM) recently appointed Gary Aitkenhead as Executive Vice President and General Manager of Data Centers, a move that bolsters its leadership team amid broader market turmoil. Despite this executive change, the company's shares saw an 8% decline in the past month, likely influenced by the overall downturn in market sentiment due to ongoing tariff uncertainties. As markets, including the Dow and S&P 500, faced significant pressures with declines of 2% and 1.8% respectively, it reflects widespread investor trepidation impacting various sectors, which could have indirectly affected Iron Mountain's share performance.

We've identified 5 risks for Iron Mountain (2 are a bit unpleasant) that you should be aware of.

The appointment of Gary Aitkenhead as Executive Vice President and General Manager of Data Centers could influence Iron Mountain's future revenue and earnings forecasts. His role may strengthen the company's data center operations, potentially aiding the expansion plans in the Middle East and enhancing market presence, as outlined by Iron Mountain's strategy. The new leadership could drive initiatives that leverage cross-selling opportunities with existing clients, potentially uplifting revenue growth and operational efficiency.

Over a longer five-year period, Iron Mountain has delivered a total shareholder return of 264.87%, including both share price appreciation and dividends. This is a sharp increase when considering the recent 8% share price decline over the past month. Relative to the industry's average last year, Iron Mountain underperformed the US Specialized REITs industry, which returned 0.2%. However, Iron Mountain surpassed the broader US market, which saw a return of 3.3%, highlighting resilience amid broader market pressures.

The company's recent share price decline positions it at US$86.89, which remains substantially below the consensus analyst price target of US$116.12, suggesting a potential upside if forecasts are met. However, investors should remain cautious of factors that could affect revenue expectations, particularly economic and regulatory changes in key regions. Such risks might impact partnerships, like those with Ooredoo, and subsequent revenue from data center expansions. Assessing how these play out in the evolution of Iron Mountain's market strategy will be critical for its future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal