US Undiscovered Gems To Watch In April 2025

As the U.S. stock market faces heightened volatility and uncertainty due to ongoing tariff discussions, small-cap stocks have been particularly impacted, with indices like the S&P 600 experiencing significant fluctuations. In such a turbulent environment, identifying potential opportunities in lesser-known companies requires a keen eye for resilience and growth potential amidst broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Omega Flex (NasdaqGM:OFLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Omega Flex, Inc. specializes in the production and distribution of flexible metal hoses, fittings, and accessories across various regions including the United States and Canada, with a market capitalization of $332.91 million.

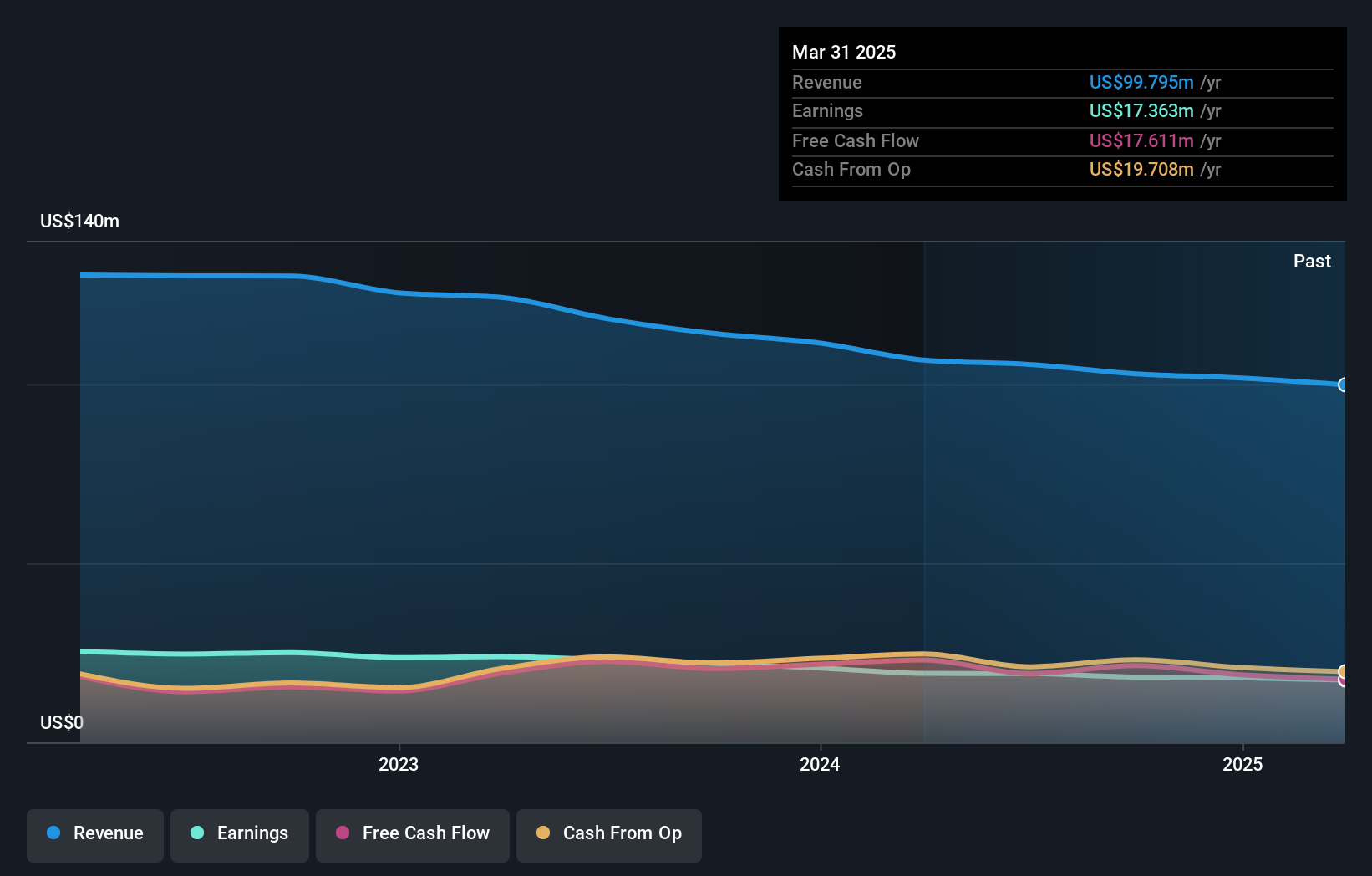

Operations: Omega Flex generates revenue of $101.68 million from the manufacture and sale of flexible metal hoses and accessories.

Omega Flex, a smaller player in the machinery industry, stands out with its debt-free balance sheet and high-quality earnings. Despite reporting a 13.2% negative earnings growth last year against the industry's 8.9% average, it remains profitable with a free cash flow of US$21.39 million as of September 2024. The company trades at roughly 5.5% below its estimated fair value, suggesting potential undervaluation in the market. Recent announcements include a quarterly dividend of $0.34 per share and full-year sales of US$101.68 million for 2024, indicating steady shareholder returns despite lower net income compared to the previous year.

- Click here to discover the nuances of Omega Flex with our detailed analytical health report.

Evaluate Omega Flex's historical performance by accessing our past performance report.

Five Point Holdings (NYSE:FPH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Five Point Holdings, LLC designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County with a market capitalization of approximately $731.78 million.

Operations: Five Point Holdings generates revenue primarily from its developments in Great Park ($708.76 million) and Valencia ($140.84 million). The company experiences a significant deduction due to the removal of Great Park Venture (-$612.81 million).

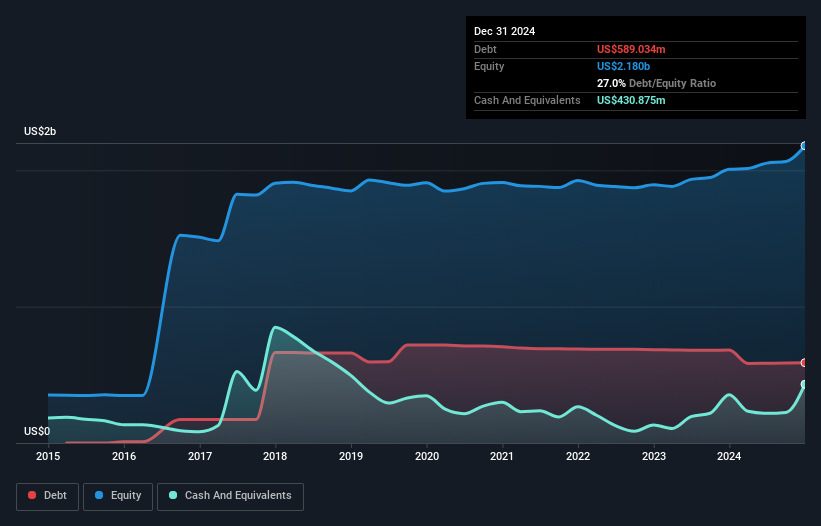

Five Point Holdings, a notable player in real estate, is making waves with its impressive financial strides. Net income jumped to US$68.3 million in 2024 from US$55.39 million the previous year, showcasing robust growth. The company's net debt to equity ratio stands at a satisfactory 7.2%, reflecting prudent financial management over five years as it reduced from 37.6% to 27%. Despite recent share price volatility, Five Point trades at an attractive discount of 24.6% below estimated fair value and boasts high-quality earnings with free cash flow turning positive recently at US$115 million by end-2024.

- Take a closer look at Five Point Holdings' potential here in our health report.

Gain insights into Five Point Holdings' past trends and performance with our Past report.

Guaranty Bancshares (NYSE:GNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Guaranty Bancshares, Inc. is the bank holding company for Guaranty Bank & Trust, N.A., with a market capitalization of $426.41 million.

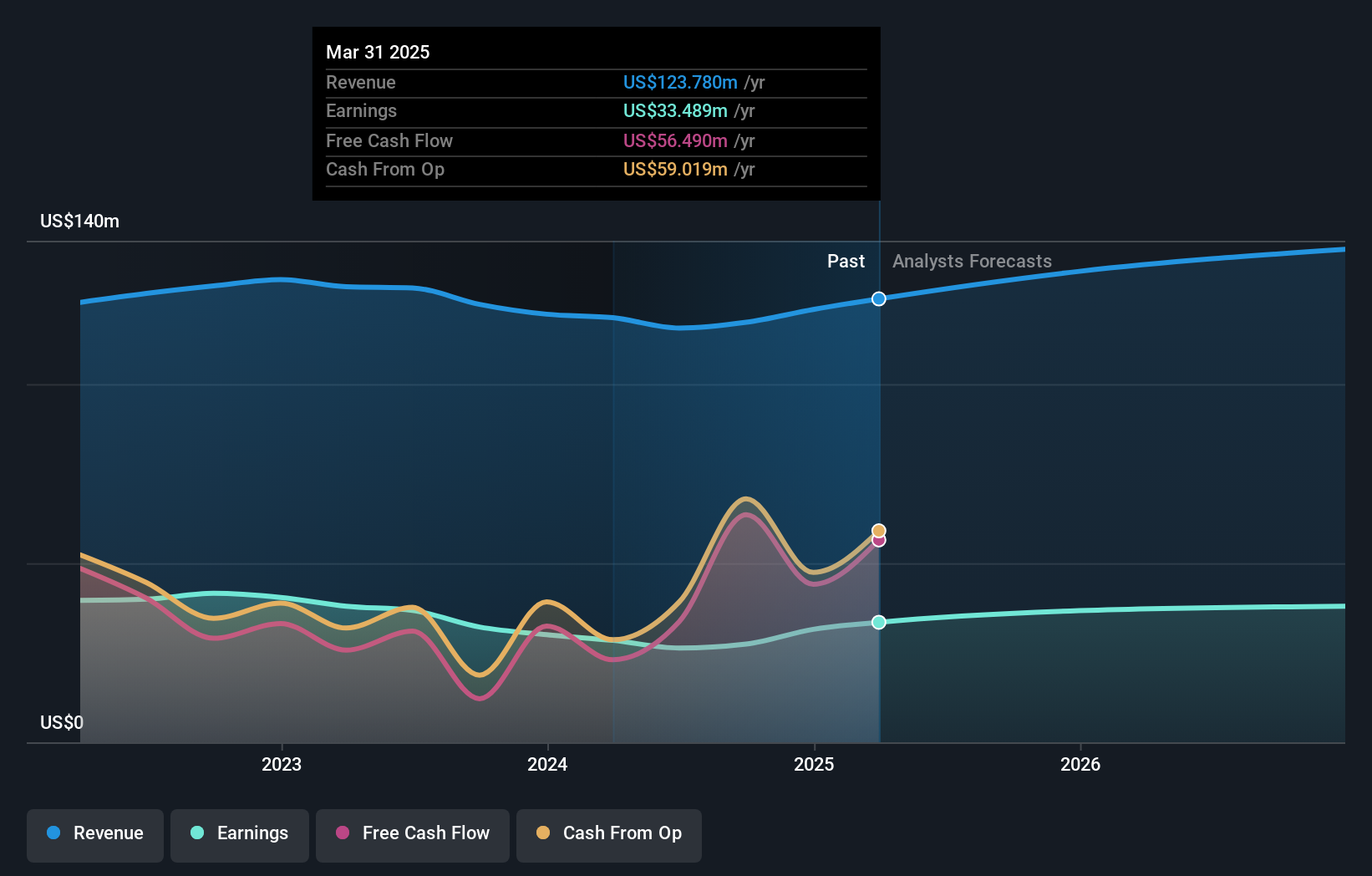

Operations: Guaranty Bancshares generates revenue primarily from its banking segment, totaling $120.82 million. The company's net profit margin reflects its profitability dynamics and operational efficiency.

Guaranty Bancshares, with assets totaling US$3.1 billion and equity of US$319 million, stands out for its robust financial health. The bank's liabilities are 96% funded by low-risk customer deposits, minimizing external borrowing risks. Total deposits amount to US$2.7 billion against loans of US$2.1 billion, reflecting a solid balance sheet structure. It maintains a net interest margin of 3.3% and an appropriate bad loan ratio at 0.2%, supported by a substantial allowance for bad loans at 759%. Recent earnings growth of 5% surpasses industry averages, indicating strong performance amid sector challenges.

Taking Advantage

- Reveal the 284 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal