Teledyne Technologies (NYSE:TDY) Faces Investor Activism Challenge Ahead Of April 2025 Meeting

Teledyne Technologies (NYSE:TDY) is currently entangled in an investor activism dispute, where shareholder John Chevedden has been challenging the management's board nominee and proposal decisions ahead of the annual meeting on April 23, 2025. During the last quarter, Teledyne's share price experienced a 5% decline, potentially impacted by the activist pressure and proxy battles. As these internal tensions unfold, broader market trends also saw setbacks, with major indices like the S&P 500 and Nasdaq entering bear market territory amidst tariff-induced turmoil. Investors are keenly watching whether Teledyne's shareholder conflicts might further influence its market performance.

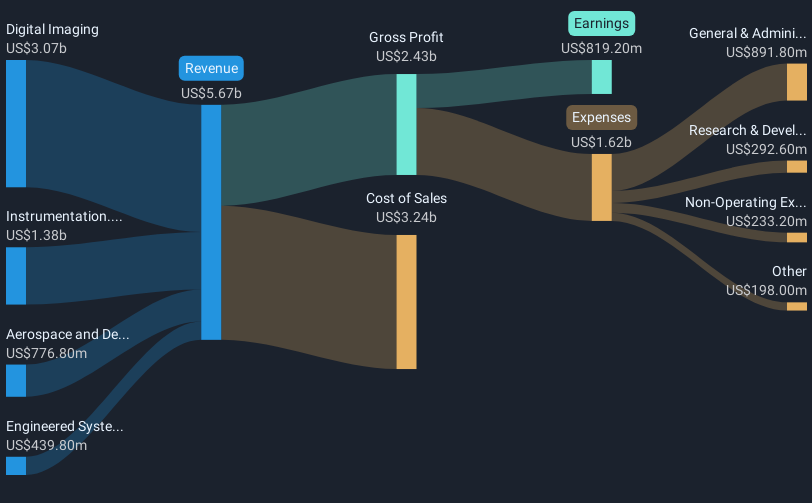

Teledyne Technologies has achieved a total shareholder return of 33.13% over the past five years, underscoring stable performance amidst varying market conditions. During this period, strategic acquisitions, such as Micropac, have likely contributed to enhanced operations and market reach. Additionally, Teledyne's Digital Imaging segment, including Teledyne FLIR, benefited from rising demand in both commercial and defense sectors, which bolstered revenues. Furthermore, disciplined capital allocation strategies, including substantial share buybacks, have reflected the company’s commitment to improving shareholder returns, with close to 885,321 shares repurchased totaling approximately US$353.93 million.

In contrast, recent earnings reports indicated challenges, with Q4 2024 showing a 39% decline in net income year-over-year. Nevertheless, Teledyne's efforts to secure significant contracts, such as the US$74.2 million deal with the U.S. Coast Guard for imaging surveillance systems, showcase initiatives to drive future earnings. Over the past year, Teledyne outperformed both the US market and the Electronic industry, which recorded negative returns of 3.3% and 6.6%, respectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal