Discovering Undiscovered Gems in the US Market April 2025

In the midst of a turbulent market environment marked by significant downturns in key indices such as the Dow Jones Industrial Average and Nasdaq Composite, investors are grappling with the implications of new tariffs and rising economic uncertainty. As these challenges unfold, identifying promising small-cap stocks that may be overlooked becomes increasingly important for those seeking potential opportunities. In this context, a good stock is often characterized by strong fundamentals and resilience to broader market volatility, making it an attractive prospect in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation operates in the United States through its subsidiaries, focusing on commercial and personal property and casualty insurance, with a market cap of $549.55 million.

Operations: ACIC generates revenue primarily from its commercial lines business, amounting to $296.66 million. The company's financial performance is influenced by its ability to manage costs and maintain profitability within the competitive insurance market.

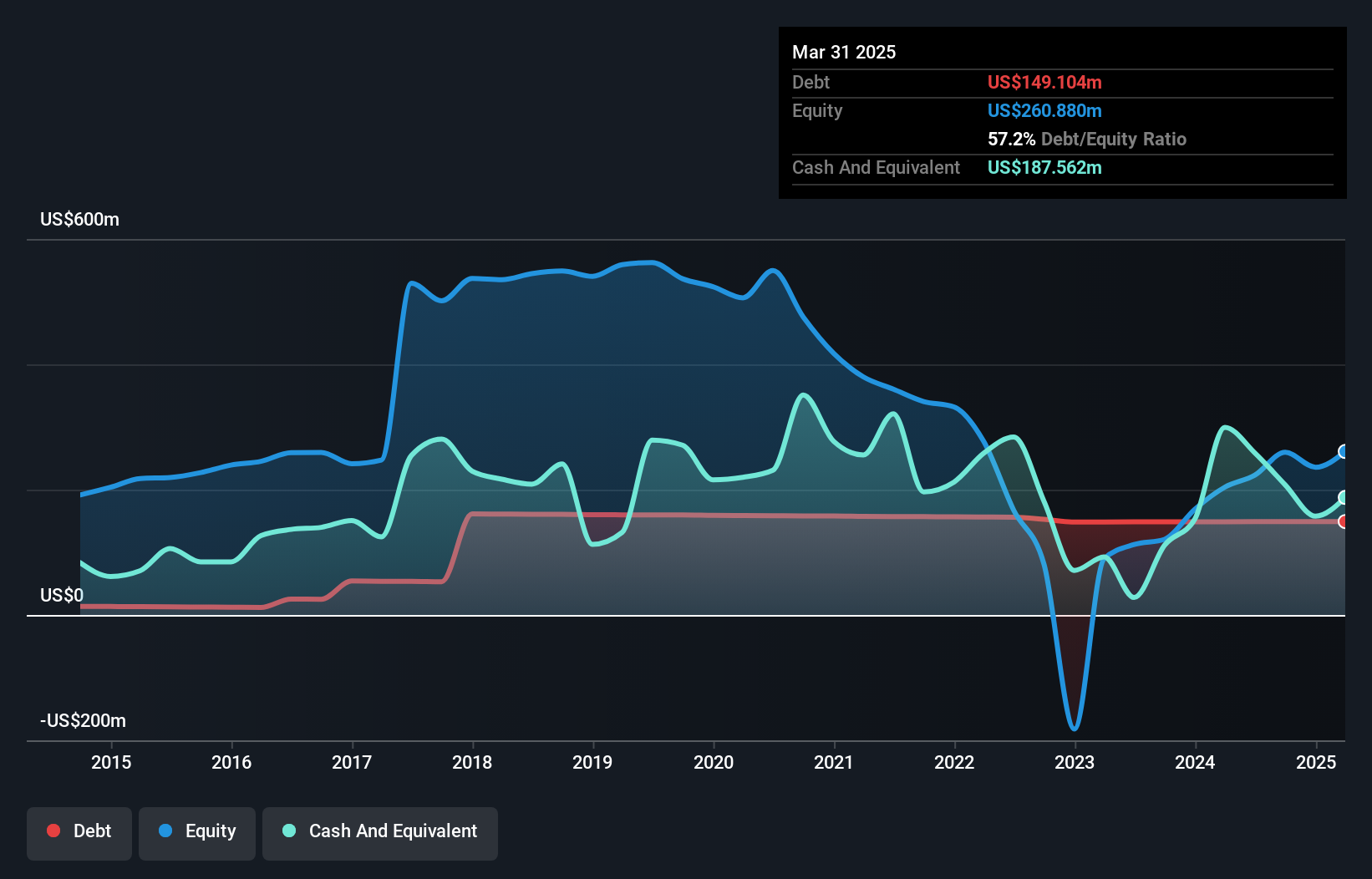

American Coastal Insurance, a small player in the insurance space, is navigating a dynamic landscape with strategic moves like the planned sale of Interboro for US$22 million to bolster financial flexibility. Despite its challenges, such as negative earnings growth of 10.4% and increased debt-to-equity ratio from 30.3% to 63.2% over five years, it trades at a good value compared to peers and industry standards. The company’s interest payments are well covered by EBIT at 9.3x, suggesting solid operational efficiency despite recent revenue growth of US$296 million not translating into proportional net income gains.

SIGA Technologies (NasdaqGM:SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company that concentrates on health security markets in the United States with a market cap of $392.90 million.

Operations: SIGA Technologies generates its revenue primarily from its pharmaceuticals segment, totaling $138.72 million. The company's financial performance can be evaluated by examining its net profit margin trends over time.

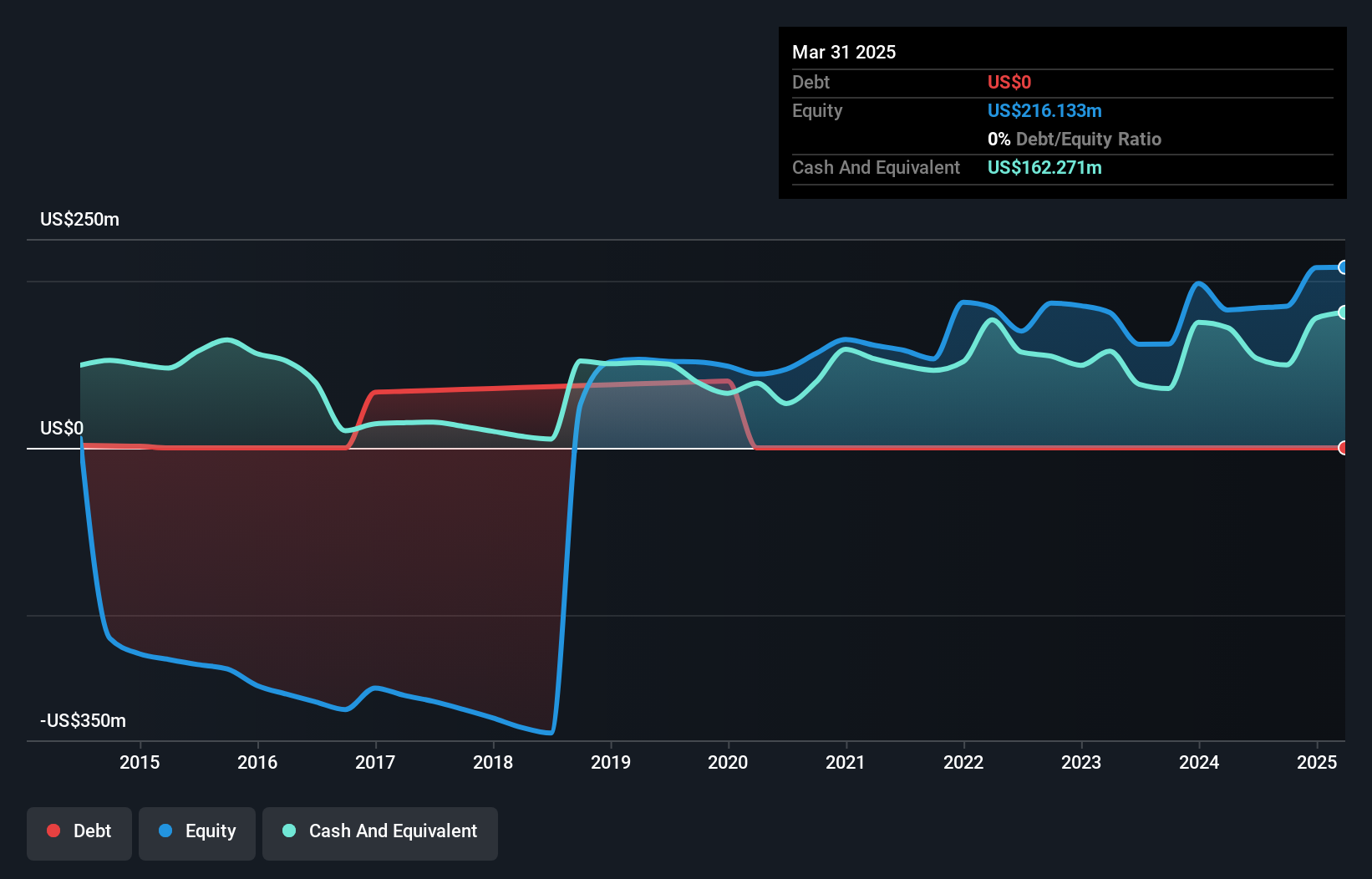

SIGA Technologies, a nimble player in the pharmaceuticals sector, showcases an enticing profile with no debt and a price-to-earnings ratio of 6.3x, significantly lower than the US market average of 17.7x. Despite recent challenges with earnings growth at -13%, contrasting sharply with the industry average of 30.5%, SIGA remains profitable and free cash flow positive. The company recently welcomed General John Keane to its board, potentially strengthening its strategic direction given his extensive leadership background. While revenue dipped to US$81 million from US$116 million year-over-year for Q4, earnings are projected to grow by over 40% annually moving forward.

Hamilton Beach Brands Holding (NYSE:HBB)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamilton Beach Brands Holding Company designs, markets, and distributes small electric household and specialty housewares appliances both in the United States and internationally, with a market cap of approximately $269.76 million.

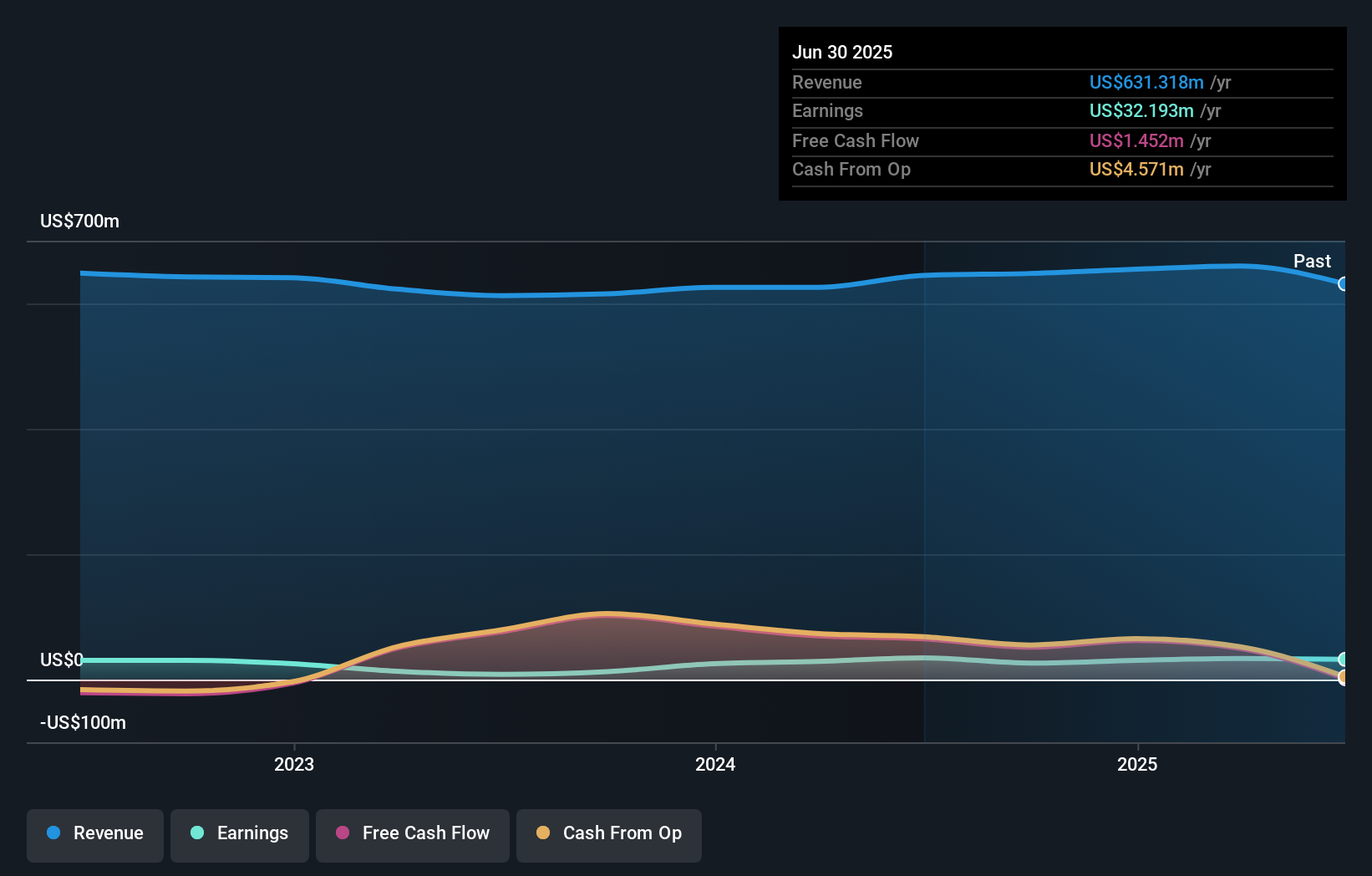

Operations: Hamilton Beach Brands Holding generates revenue primarily from its Home and Commercial Products segment, which accounts for $650.41 million, while its Health segment contributes $4.28 million.

Hamilton Beach Brands Holding, a notable player in the consumer durables sector, has been making strides with a 21.9% earnings growth over the past year, outpacing its industry peers. The company has significantly reduced its debt to equity ratio from 161.5% to 30.1% over five years, showcasing improved financial health. Recent buybacks saw 638,381 shares repurchased for $13.55 million, reflecting confidence in its undervalued stock trading at 55.8% below estimated fair value. Despite a one-off $9.6 million loss impacting recent results, Hamilton Beach's robust cash position and strategic M&A focus signal promising future prospects.

Where To Now?

- Click this link to deep-dive into the 280 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal