3 Dividend Stocks To Consider With Yields Up To 4.7%

As the U.S. stock market grapples with heightened volatility due to escalating trade tensions and economic uncertainty, investors are increasingly turning their attention to more stable investment options like dividend stocks. In such turbulent times, dividend stocks can offer a measure of stability and income, providing potential returns through regular payouts even when market conditions are challenging.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.60% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.11% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.11% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.28% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.83% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 5.07% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.69% | ★★★★★★ |

Click here to see the full list of 178 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Westamerica Bancorporation (NasdaqGS:WABC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial clients in the United States, with a market cap of approximately $1.34 billion.

Operations: Westamerica Bancorporation generates its revenue primarily through its banking segment, which accounted for $293.25 million.

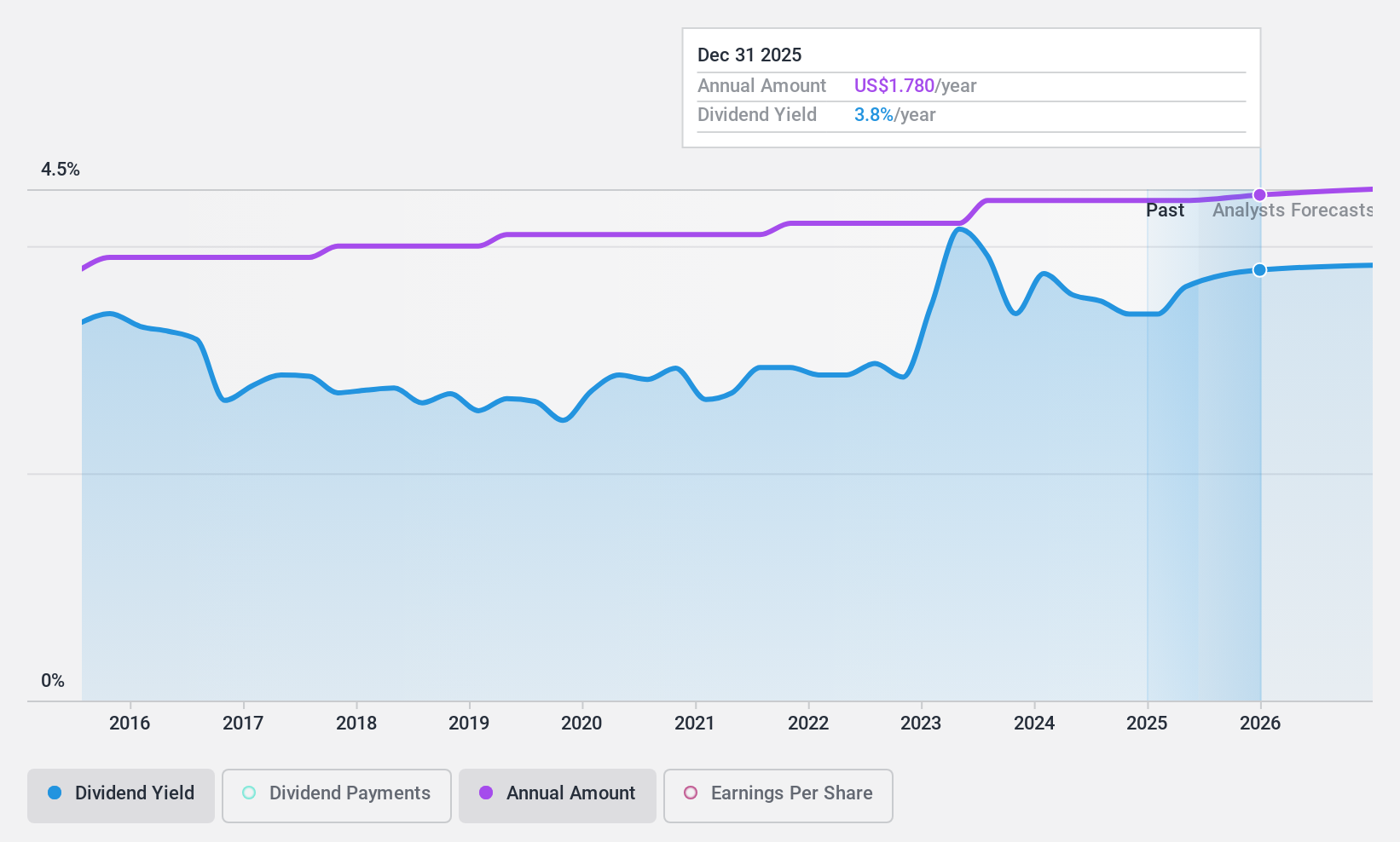

Dividend Yield: 3.7%

Westamerica Bancorporation offers a stable and reliable dividend, with payments consistently growing over the past decade. The dividend yield of 3.67% is modest compared to top-tier US payers but is well-covered by earnings, maintaining a low payout ratio of 33.9%. Recent announcements include a share repurchase program for up to 2 million shares, enhancing shareholder value. Despite declining earnings forecasts, the company continues to prioritize returning capital to shareholders through dividends and buybacks.

- Click here and access our complete dividend analysis report to understand the dynamics of Westamerica Bancorporation.

- In light of our recent valuation report, it seems possible that Westamerica Bancorporation is trading behind its estimated value.

Global Industrial (NYSE:GIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Industrial Company operates as an industrial distributor of MRO products in the United States and Canada, with a market cap of approximately $876.18 million.

Operations: Global Industrial Company's revenue primarily comes from its Industrial Products Group (IPG), which generated $1.32 billion.

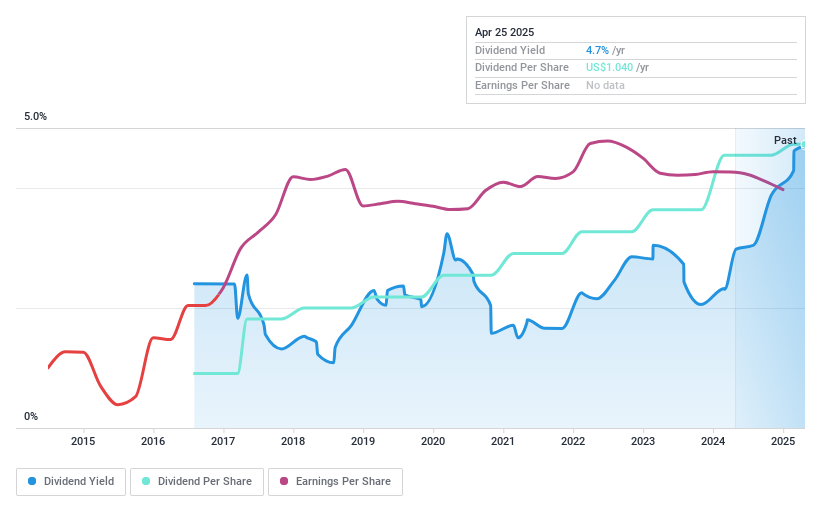

Dividend Yield: 4.8%

Global Industrial's dividend yield of 4.77% ranks in the top 25% of US payers, supported by a payout ratio of 63.5% from earnings and 85% from cash flows, ensuring coverage. Although dividends have been stable and growing over nine years, the company's recent earnings report shows a decline with net income at US$61 million for 2024. Upcoming executive changes may influence future performance as Anesa Chaibi takes over as CEO.

- Take a closer look at Global Industrial's potential here in our dividend report.

- According our valuation report, there's an indication that Global Industrial's share price might be on the cheaper side.

Bank of N.T. Butterfield & Son (NYSE:NTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of N.T. Butterfield & Son Limited offers community, commercial, and private banking services to individuals and small to medium-sized businesses, with a market cap of approximately $1.69 billion.

Operations: The Bank of N.T. Butterfield & Son Limited generates revenue primarily from its banking segment, amounting to $579.93 million.

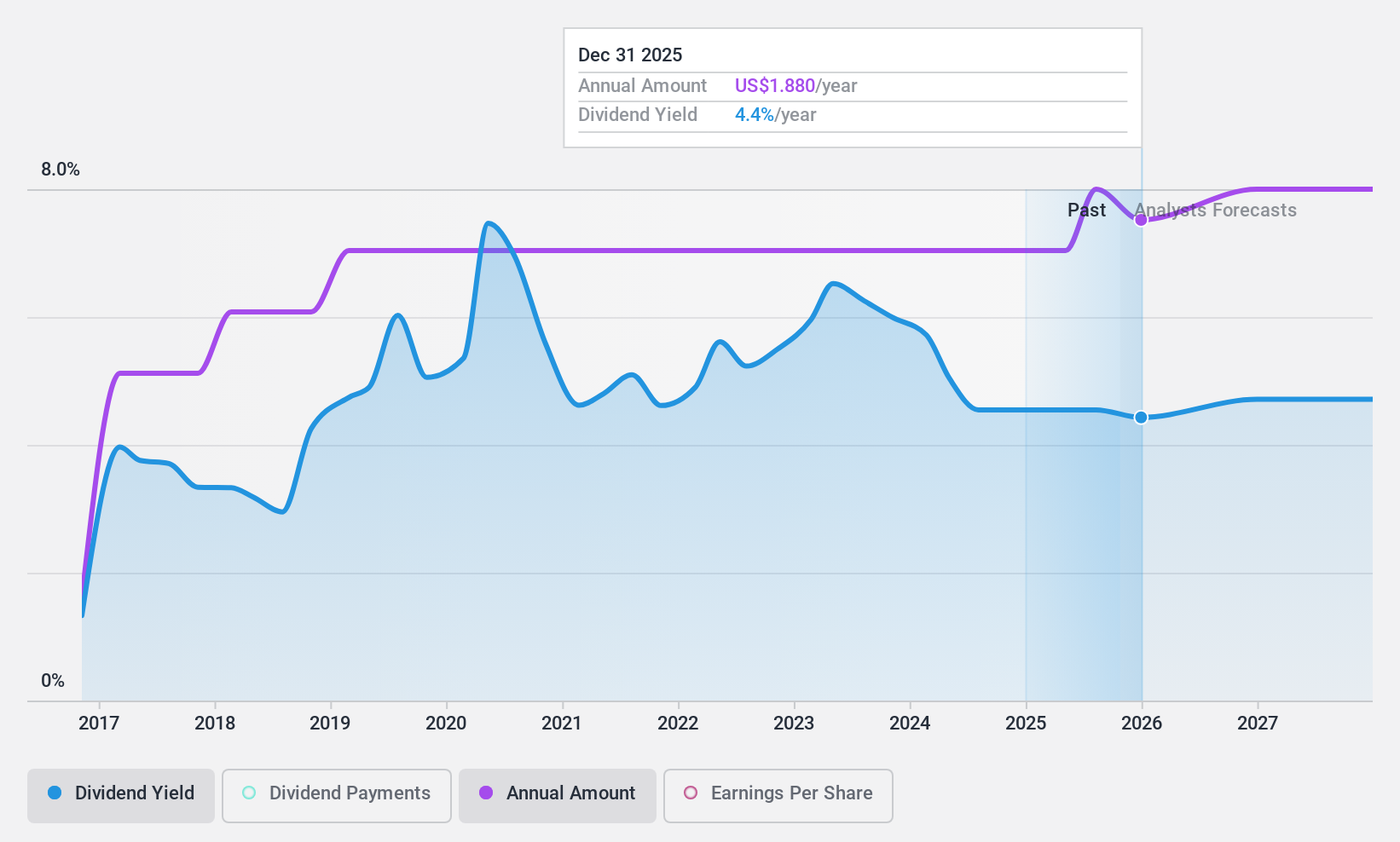

Dividend Yield: 4.7%

The Bank of N.T. Butterfield & Son's dividend yield of 4.75% is among the top 25% in the US, with a sustainable payout ratio of 36.7%, indicating strong coverage by earnings. Despite only nine years of payments, dividends have been stable and reliable. Recent financials show net income at US$216.3 million for 2024, slightly down from the previous year, while a recent buyback completed shares worth US$69.76 million, enhancing shareholder value amid high bad loans at 3.3%.

- Dive into the specifics of Bank of N.T. Butterfield & Son here with our thorough dividend report.

- The analysis detailed in our Bank of N.T. Butterfield & Son valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Navigate through the entire inventory of 178 Top US Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal