Where Equifax Stands With Analysts

10 analysts have shared their evaluations of Equifax (NYSE:EFX) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 3 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

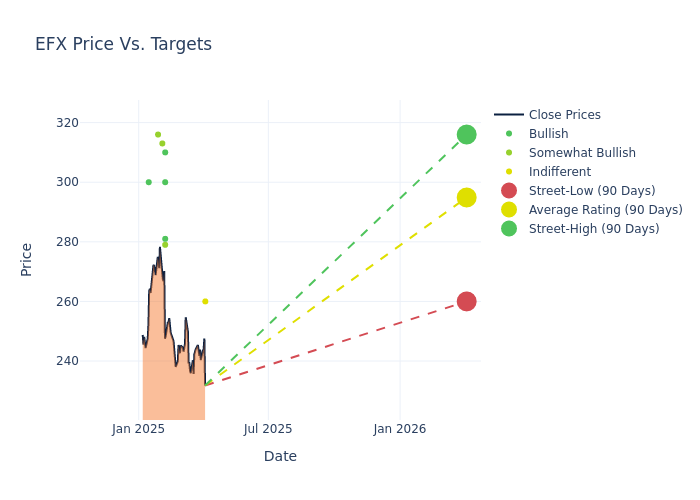

The 12-month price targets, analyzed by analysts, offer insights with an average target of $300.5, a high estimate of $325.00, and a low estimate of $260.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 5.98%.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Equifax among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Manav Patnaik | Barclays | Lowers | Equal-Weight | $260.00 | $325.00 |

| Manav Patnaik | Barclays | Lowers | Overweight | $325.00 | $335.00 |

| Owen Lau | Oppenheimer | Lowers | Outperform | $279.00 | $286.00 |

| Kevin Mcveigh | UBS | Lowers | Buy | $310.00 | $335.00 |

| Shlomo Rosenbaum | Stifel | Lowers | Buy | $281.00 | $284.00 |

| Kyle Peterson | Needham | Lowers | Buy | $300.00 | $325.00 |

| Jason Haas | Wells Fargo | Lowers | Overweight | $313.00 | $321.00 |

| Toni Kaplan | Morgan Stanley | Lowers | Overweight | $316.00 | $320.00 |

| Surinder Thind | Jefferies | Lowers | Buy | $300.00 | $340.00 |

| Jason Haas | Wells Fargo | Lowers | Overweight | $321.00 | $325.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Equifax. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Equifax compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Equifax's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Equifax's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Equifax analyst ratings.

Get to Know Equifax Better

Along with Experian and TransUnion, Equifax is one of the leading credit bureaus in the United States. Equifax's credit reports provide credit histories on millions of consumers, and the firm's services are critical to lenders' credit decisions. In addition, over 40% of the firm's revenue comes from workforce solutions, which provides income verification and employer human resources services. Equifax generates just over 20% of its revenue from outside the United States.

Understanding the Numbers: Equifax's Finances

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Equifax displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 7.0%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 12.26%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Equifax's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.59%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Equifax's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.44%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 1.04, Equifax adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal