US Undiscovered Gems To Watch In April 2025

In the wake of recent market turbulence sparked by President Trump's sweeping tariffs, U.S. stock indexes have experienced their most significant declines since 2020, with small-cap stocks particularly impacted. Amidst this volatile environment, investors might find potential opportunities in lesser-known companies that demonstrate resilience and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Global Indemnity Group, LLC operates through its subsidiaries to offer specialty property and casualty insurance and reinsurance products in the United States, with a market capitalization of approximately $490.48 million.

Operations: The company generates revenue primarily from its Penn-America segment, contributing $371.14 million, and non-core operations adding $7.22 million. Unallocated net investment income is reported at $62.38 million, with a minor contribution from unallocated net realized investment gains of $0.46 million.

Global Indemnity Group, with its strategic focus on InsurTech and catastrophe management, is eyeing growth through Project Manifest. This initiative aims to boost operational efficiency and explore new underwriting opportunities. The company has seen earnings grow by 71% over the past year, outpacing the insurance industry's 22%. With a price-to-earnings ratio of 11.3x against the US market's 17.7x and no debt compared to a debt-to-equity ratio of 42% five years ago, it presents a solid financial footing. However, challenges like high expense ratios and wildfire modeling risks could impact future performance despite projected annual revenue growth of 10%.

Lindsay (NYSE:LNN)

Simply Wall St Value Rating: ★★★★★★

Overview: Lindsay Corporation, with a market cap of $1.42 billion, offers water management and road infrastructure products and services both in the United States and internationally.

Operations: Lindsay generates revenue through its offerings in water management and road infrastructure sectors. The company's net profit margin is 6.5%, indicating its efficiency in converting sales into actual profit after expenses.

Lindsay Corporation, a notable player in the irrigation and infrastructure sectors, is gaining traction with its strategic focus on international markets like MENA. Recent earnings show a solid performance with second-quarter sales hitting US$187 million, up from US$151 million last year, while net income rose to US$26.58 million from US$18.12 million. The company has reduced its debt-to-equity ratio significantly over five years to 22.3%, enhancing financial stability. With earnings growth of 11% surpassing the industry average and trading at 20.8% below estimated fair value, Lindsay appears well-positioned for future expansion despite regional market challenges.

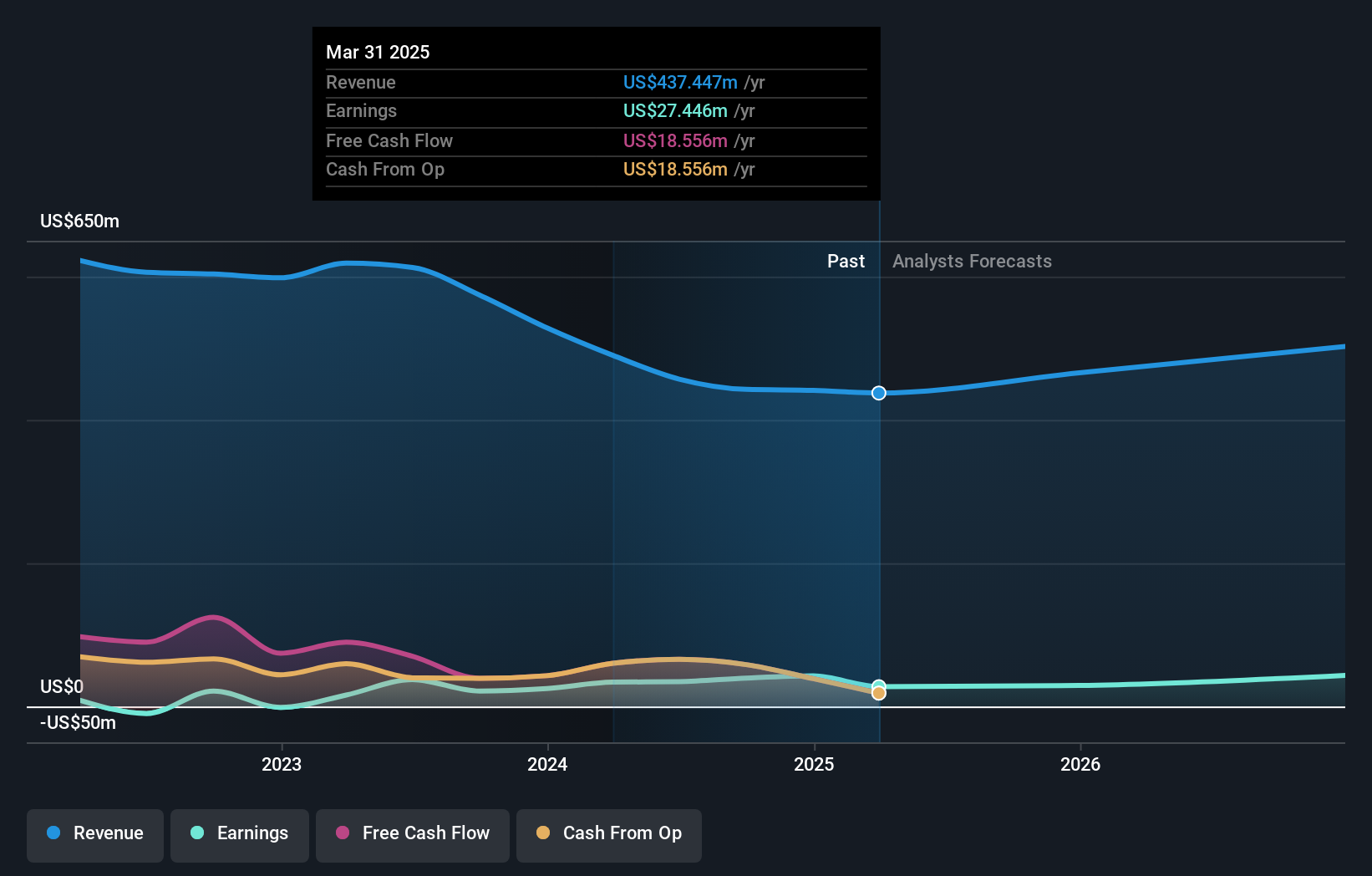

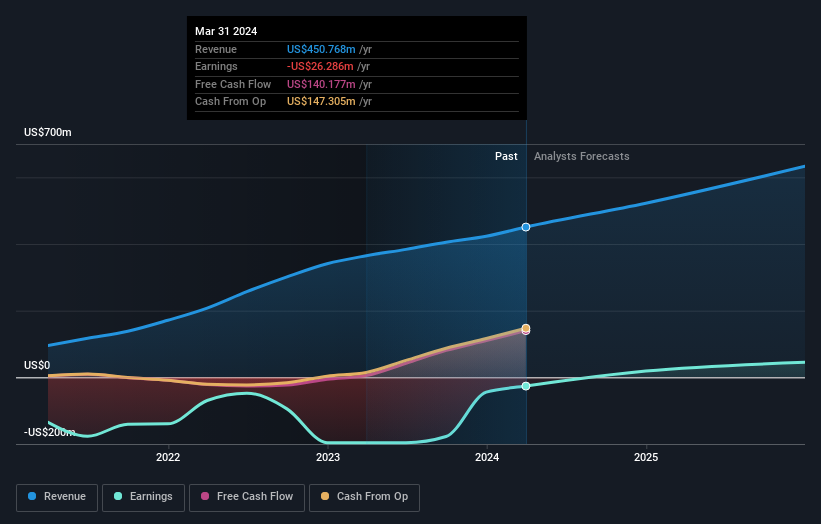

MoneyLion (NYSE:ML)

Simply Wall St Value Rating: ★★★★★☆

Overview: MoneyLion Inc. is a financial technology company that offers personalized products and financial content to consumers in the United States, with a market cap of $984.51 million.

Operations: Revenue from data processing amounted to $545.91 million.

MoneyLion, a nimble player in the fintech space, has turned profitable with net income of US$9.15 million for 2024, bouncing back from a US$45.25 million loss the previous year. Revenue jumped to US$545.91 million from US$423.43 million, indicating robust growth as it expands into credit cards and mortgages. The firm's debt-to-equity ratio improved significantly over five years to 40.7%, showcasing better financial management despite interest payments being poorly covered by EBIT at 1.1x coverage. With earnings projected to rise annually by 77%, MoneyLion's strategic moves could enhance its market position amidst industry challenges like high acquisition costs and regulatory shifts.

Turning Ideas Into Actions

- Access the full spectrum of 280 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal